Refunds and returns are a normal part of managing an online parts business. Handling them quickly and accurately helps maintain customer trust, ensures compliance with your OEM’s policies, and keeps your accounting and inventory records up to date.

Before processing a refund or return

Before issuing a refund or accepting a return, review the order details and confirm the situation.

Confirm the reason for return or refund: Determine whether it’s due to a customer error, damaged product, incorrect part, or fulfillment issue

Check order status and payment type: Make sure the original transaction was successfully processed and settled through your payment gateway (e.g., Stripe, PayPal, or Authorize.Net)

Review return eligibility: Verify that the product meets your brand or OEM’s return policy (e.g., timeframe, condition, or restocking rules)

Communicate with the customer: Let the customer know the next steps — whether to ship the product back, provide photos, or expect a credit

💡 Tip: Clear communication before refunding can prevent misunderstandings and unnecessary disputes.

Steps to process a refund in the Control Panel

Once an order has been cancelled, it is imperative that you manually issue the customer a refund. Refunds are handled differently depending on the type of payment account established for your SimplePart website. Most sites will have the ability to accept credit card payments; however, many also accept payment through PayPal.

To handle a refund, you must first identify how the customer paid for their order. The Order Details tab will display their payment method under the Order Summary section. The payment method will either be PayPal or Payment Gateway (credit card payment).

Refunding an order made by Credit Card:

It is possible to issue either a partial or full refund to a customer's credit card within the Control Panel.

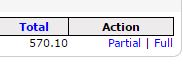

In Billing Details, you can find the transaction, along with an action column to the right displaying “Partial | Full.” This option will only be displayed if the original transaction was captured.

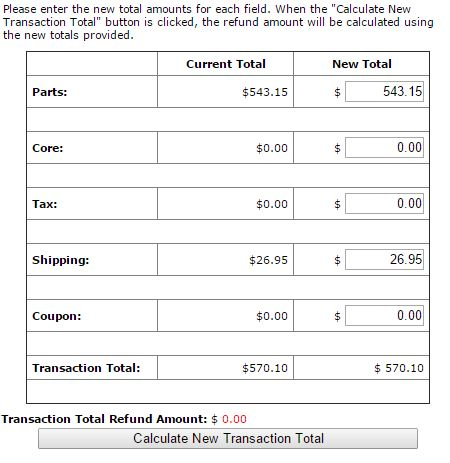

In order to issue a partial refund, you will need to zero out any applicable totals on the New Total column.

To issue a refund for shipping, tax, coupon, or parts:

Zero out the corresponding field in the New Total column.

Determine your new total refund amount

Click Calculate New Transaction Total.

For example, if we were to issue a refund on just the shipping in the graphic below, we would make sure the new total was $0.00 instead of $26.95 before clicking “Calculate New Transaction Total.” Always make sure the new total fields equal the new invoice total the customer is being billed.

Tip: A refund can only be issued 24 hours after a payment has been captured.

Refunding a PayPal order:

For all orders placed through PayPal, you will need to issue refunds through your PayPal account.

Log in to your PayPal account.

Click “History”.

Click “Details” next to the payment you want to refund.

Click “Issue a Refund.”

Enter the refund amount, then click “Continue.”

Review the information, then click “Issue Refund.”

Click here for additional instructions on issuing a refund in PayPal.

Refund notifications

Customers appreciate being informed once a refund has been issued.

Automatic notifications: [Placeholder – indicate whether the system automatically sends an email confirmation of refund]

Manual follow-up: If your system does not automatically notify customers, send a brief confirmation email including refund amount, payment method, and estimated processing time

🕓 Refunds typically take between [x] business days to appear on the customer’s statement, depending on their bank or payment provider.

Impact on accounting and reporting

Refunds directly affect your sales metrics and financial reports.

Revenue reporting: Refunds reduce total monthly sales figures and are reflected in your Control Panel’s financial summaries

Accounting coordination: Communicate refunds or chargebacks to your accounting team to ensure accurate reconciliation. Check with your payment processor if you see a discrepancy.

Handling refunds related to fraud or chargebacks

Fraud-related refunds should be addressed immediately to minimize losses.

Mark the order as “Fraud” in the Control Panel: This flags it across the SimplePart system and prevents repeat transactions from the same source

Coordinate with your payment gateway: PayPal, Stripe, and Authorize.Net each provide dispute resolution and chargeback management tools

Gather documentation: Retain order details, communication records, and tracking numbers in case of a chargeback claim

Follow up with the customer if appropriate: In some cases, contacting the customer may help confirm legitimacy or resolve disputes before escalation

🔗 See also: Best practices for preventing fraud using Control Panel features

Best practices

Issue refunds promptly once verified

Keep clear documentation for every refund and return

Monitor refund trends — a sudden increase may indicate process issues or fraudulent behavior

Train your team to follow a consistent refund and return process

Need help?

Our in-house Client Services team is available Monday-Friday, 8 a.m. to 8 p.m. EST to help you with any questions or issues. You can reach us in the following ways:

👉 Submit a request through this support form

📞 Call us at 1 (888) 843-0425

📧 Email us at support@simplepart.com

We’re ready to help you get the most out of your SimplePart experience!